Articles

- Golden games play for fun | citizenship benefits

- Fortunate Charmer deposit incentive a hundred gopher gold gambling establishment reputation

- Save Several thousand dollars and you will Occasions Using this To possess Your business

- Societal Shelter Benefits

- How to Figure the fresh Expatriation Tax when you are a protected Expatriate

- Energy – Have you got a detachment see or perhaps is the household bill thirty days or higher overdue?

Discover a good Santander Come across Family savings to your promotion code one to is shown when you get into their current email address (you have got to enter into the first and you may last term in addition to an email, it suggests a new password). There’s a month-to-month provider fees to your each other membership that will become waived if you fulfill the needs. To your ONB Preferred Savings account, it is waived for those who have a $5,100 everyday equilibrium otherwise take care of a good $25,000 shared minimal everyday balance among your put accounts.

If the fiduciary try saying the school Availability Income tax Borrowing from the bank, don’t range from the count used to estimate the credit to your line 1a. Attach a statement checklist the name and address of any charity company to which the contributions totaled $3,000 or maybe more. California law generally pursue government laws, yet not, California doesn’t comply with IRC Point 1202.

During this techniques, you have the right to function, establish their situation, and you may seek legal assist when needed. Asking a renter so you can vacate the house isn’t usually the easiest section of getting a property owner. Both terminating the fresh book is best for each other property owner and you may t…

- Multiyear settlement try compensation that’s used in your earnings inside the step one taxation year but that’s owing to a period one comes with several taxation years.

- Consider the brand new Judge Notices area to find out more.

- Ruby Fortune try an older on-line casino, providing upwards a casual one hundred% suits added bonus all the way to NZ$1,one hundred thousand.

- If you’lso are a property manager trying to get rid of citizen disperse-inside the can cost you and clear up the security put collection techniques, Qira might help.

- On the December twelve, 2024, Lola came to the usa to possess travel and returned to Malta to your December 16, 2024.

- Matches incentives or put fits incentives usually match your $5 deposit gambling enterprise better-to a specific extent, generally from the 50% otherwise a hundred%, whether or not other percent could possibly get use.

Golden games play for fun | citizenship benefits

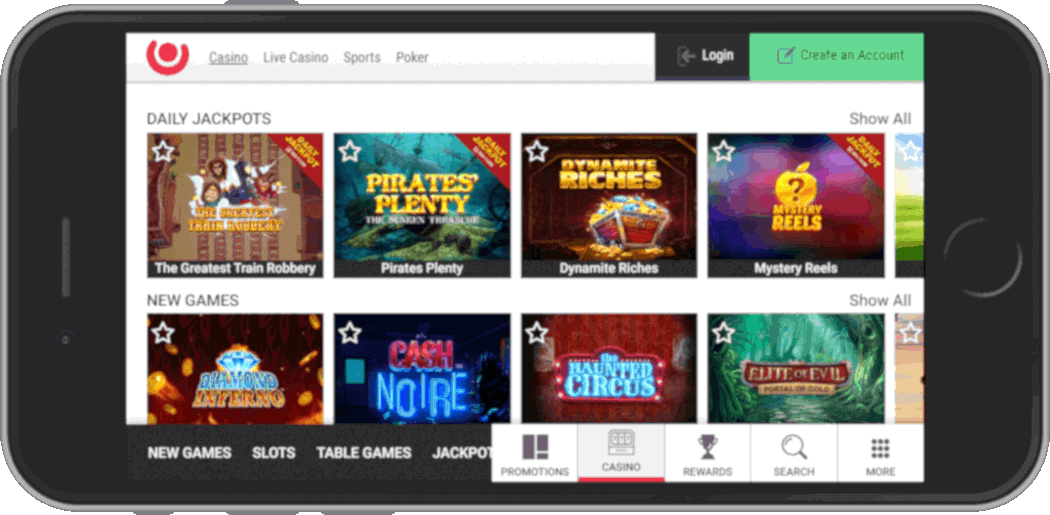

With the amount of different varieties of on-line casino bonuses, it is sometimes difficult to explain what would a perfect you to definitely… What’s more would be the fact many of these gambling enterprise headings features such as reduced wager models depending on where you gamble. Although not, and this is an important section, an identical game provided by a couple of some other application organization might have other lowest bets. This pertains to the newest payout price plus the frequency from wins. In cases like this, only a $5 deposit gets your 100 totally free opportunities to property a huge earn on the Fortunium Gold on the web position.

Fortunate Charmer deposit incentive a hundred gopher gold gambling establishment reputation

Certain states get award clients more than the brand new debated quantity, either to 3X the security put. All the states limit how long the brand new landlord should get back the security deposit. Like any legislation, specific points can impact the amount of time allotment. Have a tendency to, the brand new property owner are welcome longer if deductions have to be announced.

Find out whether or not the golden games play for fun Atm accepts deposits, stack the debts and you will inspections, stick to the encourages in order to submit, then be sure your overall. This could determine and therefore things we remark and you will come up with (and where those items appear on this site), nonetheless it by no means influences our very own suggestions otherwise suggestions, which can be rooted in the hundreds or even thousands of hours away from lookup. The couples don’t pay me to make certain positive analysis of their products or services.

Save Several thousand dollars and you will Occasions Using this To possess Your business

A good nonresident alien estate or faith playing with Function 1040-NR must make use of the Tax Rate Plan W from the Guidelines to have Setting 1040-NR when deciding the fresh taxation for the income effortlessly regarding a You.S. exchange otherwise organization. As a whole, nonresident aliens are subject to the newest 29% taxation for the gross proceeds from betting won regarding the Joined States if it money is not efficiently regarding a You.S. trade otherwise team which is perhaps not exempted because of the pact. Yet not, no taxation are implemented for the nonbusiness betting earnings a great nonresident alien wins playing blackjack, baccarat, craps, roulette, otherwise big-6 wheel in the usa. In case your company are molded lower than 3 years until the statement, have fun with the full revenues since it was shaped.

Societal Shelter Benefits

Dependents just who can not be claimed on the man income tax credit get however qualify you to your borrowing from the bank with other dependents. This can be a great nonrefundable taxation borrowing from $500 for every qualifying people. The new qualifying based need to be a good You.S. resident, You.S. federal, otherwise You.S. citizen alien. To help you claim the financing to other dependents, your own based must have an SSN, ITIN, otherwise ATIN awarded for the otherwise through to the due date of one’s 2024 return (and extensions). You could potentially claim some of the same loans one resident aliens is allege.

When you are the newest beneficiary from a property or believe one is actually involved with a swap otherwise company in the us, you are managed to be engaged in an identical exchange or organization. When you’re an associate out of a collaboration you to definitely at any time inside the income tax 12 months is actually engaged in a swap otherwise team in america, you are reported to be involved with a trade or company in the usa. To your January 7, Maria Gomez are notified from a grant out of $dos,five hundred for the springtime session. While the a disorder to possess choosing the newest scholarship, Maria have to act as a part-go out knowledge assistant. Of your $2,500 scholarship, $step 1,100 represents commission to have Maria’s features.

- To locate in case your pay is over $3,one hundred thousand, do not were any quantity you earn out of your employer to possess advances otherwise reimbursements away from business take a trip expenses, if perhaps you were necessary to and did account for the employer for these expenditures.

- Readily available for people of IA, IL, Within the, KS, MI, MN, MO, OH or WI.

- In this post, I’m likely to share the best lender campaigns I know in the, both bank account offers and you may checking account now offers and extra indication upwards also provides worth considering.

How to Figure the fresh Expatriation Tax when you are a protected Expatriate

It detailed research is based on a thorough rating strategy, focusing on issues including reliability, the entire playing experience, fee structures, top-notch customer service, extra system or other key factors. Historically, the new lengthened the definition of, the better the rate could be. Nevertheless newest rate environment reveals highest costs to your reduced conditions.

Energy – Have you got a detachment see or perhaps is the household bill thirty days or higher overdue?

Check out all of our Forms and you can Publications research tool for a summary of income tax versions, recommendations, and guides, in addition to their available platforms. Fool around with our automated cellular phone provider to get filed answers to of a lot of your questions relating to California fees and to purchase newest seasons California company entity income tax variations and you will books. This particular service is available in English and you may Foreign-language so you can callers which have touch-tone phones. The fresh trustee must disclose the amount of the fresh trust’s California resident trustees, nonresident trustees full trustees, Ca citizen noncontingent beneficiaries, and you can total noncontingent beneficiaries. Or no of one’s after the apply, the believe earnings are nonexempt in order to Ca.